Future Value of Annuity Calculator

The future value of annuity calculator is a compact tool that helps you to compute the value of a series of equal cash flows at a future date. In other words, with this annuity calculator, you can estimate the future value of a series of periodic payments. You can also use it to find out what is an annuity payment, period, or interest rate if other values are given. Besides, you can read about different types of annuities and get some insight into the analytical background.

If this topic is of interest to you, make sure to check out the time value of money calculator as well!

What is an annuity?

Annuity refers to a specific type of financial construction that involves a series of payments over a certain period of time, regardless of the direction of the flow of the money (i.e., the money being paid to you or you pay the money to someone else). Annuities must also satisfy two conditions: that the payments are equal and are made at fixed intervals. For example, 200 dollars paid at the end of each of the next ten years is a 10-year annuity.

If you happen to deal with an annuity, there are two aspects to be considered: the present and future value of the annuity. This calculator will estimate the future value of annuities for you, but if you are interested in finding out the present value of an annuity, please visit our present value of annuity calculator.

Types of annuities

There are multiple ways to classify annuities. You may hear about a life annuity where payments are handed out for the rest of the purchaser's (annuitant) life. Since this kind of annuity is only paid under particular circumstances, it is called a contingent annuity (i.e., it is contingent on how long the annuitant lives for). If the contract specifies the period in advance, we call it a certain or guaranteed annuity.

Annuities are also distinguished according to the variability of payments. There are fixed annuities, where the payments are constant, but there are also variable annuities that allow you to accumulate the payments and then invest them on a tax-deferred basis. There are also equity-indexed annuities where payments are linked to an index.

The most important way to differentiate annuities from the view of the present calculator is the timing of the payments.

In this context, there are two types of annuities:

-

Ordinary annuity: payments are made at the ends of the periods – mortgages, car loans, and student loans are conventionally ordinary annuities.

-

Annuity due: Payments are made at the beginning of each period – rental lease payments, life insurance premiums, and lottery payoffs (if you have the fortune to win one!)

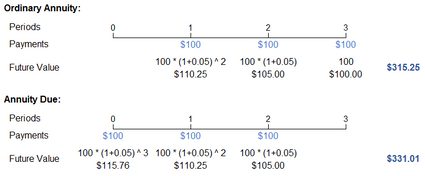

The easiest way to understand the difference between these types of annuities is to consider a simple example. Let's assume that you deposit 100 dollars annually for three years, and the interest rate is 5 percent; thus, you have a $100, 3-year, 5% annuity.

Payment Amount = 100 dollars

Interest Rate = 5%

Annuity Term = 3 years

The graph below shows the timelines of the two types of annuity with their future values. As you can see, in the case of an annuity due, each payment occurs a year before the payment at the ordinary annuity. The advanced payments immediately affect the future value of the annuity as the money stays in your bank for longer and, therefore, earns interest for one additional period. Therefore, with the annuity due, the future value of the annuity is higher than with the ordinary annuity.

The graph also visually explains how an annuity's future value is calculated: it is merely the sum of compounded cash flows estimated in each year. How to compute these individual payments? Look at our example for the ordinary annuity. The first payment earns interest for two periods, the second for one period, and the third earns no interest because it is made at the end of the annuity's life. This is an example of compound interest, a common feature in finance where interest is calculated on the interest.

This approach may sound straightforward, but the computation may become burdensome if the annuity covers an extended interval. Besides, other factors that need to be taken into consideration may appear and complicate the estimation even further. In the following section, you can learn how to apply our future value annuity calculator to any scenario, no matter how complex.

How to use our annuity calculator

In the previous section, we hope we provided some insight into how a simple annuity works. However, you can apply our future value of annuity calculator to help solve some more complex financial problems. In this section, you can learn how to use this calculator and the mathematical background that governs it.

To start, let's have a quick look at the parameters and terms you may encounter in our calculator:

-

Payment amount (PMT) is the amount paid in or out (cash flow) for each period.

-

Interest rate (r) is the annual nominal interest rate expressed as a percentage.

-

Annuity term constitutes the lifespan of the annuity.

-

Compounding frequency (m) refers to the number of times the interest is compounded. For example, when compounding is applied annually, m = 1, quarterly, m = 4, monthly, m = 12, etc. You can choose the frequency as continuous as well, which is an extreme form and the theoretical limit of compounding frequency. In such a case, m = infinity.

-

Payment frequency (q) indicates how often the payments will materialize.

-

Type of annuity (T) signifies the timing of the payment in each payment period (ordinary annuity: end of each payment period; annuity due: the beginning of each payment period).

-

Future value of the annuity (FVA) is the future value of any present value cash flows (payments).

In the Advanced parameters section, you can also see the following fields:

-

Growth rate of the annuity (g) is the percentage increase of an annuity in the case of a growing annuity.

-

Number of periods (t) shows the number of times the interest and growth are accrued.

-

Equivalent interest rate and Periodic equivalent interest rate are the interest rates computed when the payments and compounding occur at a different frequency (cannot be set manually).

Now that you are (hopefully) familiar with the financial jargon applied in this calculator, we will provide an overview of the equations involved in the computation.

The two basic annuity formulas are as follows:

-

Ordinary Annuity:

FVA = PMT / i × ((1 + i)n − 1)

-

Annuity Due:

FVA = PMT / i × ((1 + i)n − 1) × (1 + i)

n = m × t, where n is the total number of compounding intervals

i = r / m, where i is the periodic interest rate (rate over the compounding intervals)

For simplicity, we refer to the ordinary annuity in the following specifications.

-

Future value of a growing annuity (g ≠ i):

FVA = PMT / (i − g) × ((1 + i)n − (1 + g)n)

-

Future value of a growing annuity (g = i):

FVA = PMT × n × (1 + i)(n − 1)

-

Future value of an annuity with continuous compounding (m → ∞)

FVA = PMT / (er − 1) × (ert − 1)

where e stands for the exponential constant, which is approximately 2.718.

How do annuities work?

Annuities are life insurance products that provide a return on investment. There are two main types of annuities:

-

Fixed annuity: Provides a fixed return, similar to a certificate of deposit.

-

Variable annuity: Provides a variable return. It depends on the performance of the assets in which the annuity is invested (like stock market indexes).

Are annuity a good investment?

It always depends on your financial goals and risk tolerance. Fixed annuities are for the people who look for security the most; however, they will most likely lose buying power because of inflation. In contrast, variable annuities can return much more but have the value fluctuation characteristic.

How to calculate the future value of an annuity?

To calculate the future value of an annuity:

-

Define the periodic payment you will do (P), the return rate per period (r), and the number of periods you are going to contribute (n).

-

Calculate: (1 + r)ⁿ minus one and divide by r.

-

Multiply the result by P, and you will have the future value of an annuity. Also, you can try the Omni Calculator future value of annuity tool.

How much do I need for having an annuity of 1 million USD?

You need to invest 1316.88 USD every month on an annuity that returns 10% annually and do that for 20 years to accumulate 1,000,000 USD. You can verify this result at the Omni Calculator future value of the annuity tool.