Inflation Calculator

Inflation seems to be a buzzword lately. The inflation in the US has gone down to 6.5% compared to 9.06% back in June 2022... but is that good or bad? And most importantly, how does that affect you? Can you actually buy more things after your salary raise? Let's dive together and answer all these questions with the Inflation Calculator by Omni Calculator.

What is inflation?

Don't worry if you don't know what inflation is; the ancient Romans didn't either! The buying power of a dollar is different today than it was twenty years ago; that is, the price of goods and services changes over time. The increase in the overall level of prices is called inflation. In contrast, a persistent decline in the average price level is called deflation. These two phenomena are prevalent features of a capitalist economy, and they are a primary concern of economists and policymakers.

Inflation is a continuous increase in the prices of goods and services. In the case of inflation, the currency gradually loses its purchasing power, so its value decreases in time, so you need more of it to buy the same amount of goods or services. Therefore, the expressions "inflation" and "decrease in the value of money" are often used synonymously.

In general, policymakers aim to maintain stable prices; that is, keeping inflation low and constant, defined as an annual rate of close to 2%.

What is inflation rate?

The inflation rate refers to the rate of change expressed in percentage in the price of goods and services. When the inflation is negative, it is referred to as deflation.

How to calculate the inflation rate

Since inflation can be defined as the sustained rise in the general price level and not the price level of only one or two goods, calculating the correct inflation rate in an economy involves carefully collected data sets and sophisticated statistical methodologies.

Wondering how to calculate the inflation rate? There are several different methods; for example, the most comprehensive way is the GDP deflator, which considers the prices of all of the factors used in the computation of the Gross Domestic Product.

Still, one of the most common ways to measure inflation is to utilize the Consumer Price Index (CPI). CPI combines the prices consumers pay for a large basket of goods and services, representing the average cost of living. This basket of products and services reflects the prices of around 80 thousand items each month. In the United States, the Bureau of Labor Statistics collects the prices by calling and visiting retail stores, service enterprises (such as cable providers, airlines, car, and truck rental agencies), rental units, and medical centers across the country.

Therefore, one of the most precise ways to calculate the inflation rate is to employ a price index. Still, you may get some insight into inflation if you consider a particular group of goods and services calculation.

- Let's start with determining the time frame. Enter the start and end year into our inflation calculator. For example, you can calculate the inflation rate between 2015 and 2016.

- Determine the price of a given basket of goods or check price indexes at the given years. For the sake of simplicity, let's assume that the price index was 100 in 2015 and 105 in 2016.

- Use the following formula:

where:

- is the initial price of the basket of goods or the price index;

- is the final price of the basket of goods or the price index.

- You can also use our inflation calculator to find the result. In the above case, the price increase is 5%. For a precise calculation, you can always use the official CPI index in your country.

💡 The calculation in this tool is based on the seasonally adjusted Consumer Price Index (CPI) data published by the OECD.

Inflation in a financial context

We don't normally keep money in a locked box. Rather, we prefer to keep our savings in bank accounts or invest them. These often have a given interest rate, which causes our savings to increase from an initial value to a future value. For example, if you have $1000 in a savings account with a 3% interest rate, you will have $1030 in your account after a year. However, this is only a nominal value that is not necessarily equal to its real value.

It is likely that the general price level will change during the year, which will affect the real value of your money. So, even though you will have $1,030 in your account, each one of these dollars will be worth a bit less than it was a year earlier. If the inflation rate is, let's say, 2%, then the real value of the money in your account is approximately only $1,010. It follows that the nominal interest rate, which is offered by banks, is not the best basis for evaluating the real value of your gains. It is better to use an inflation-adjusted rate, that is, the real interest rate.

Check our real interest rate calculator if you'd like to continue reading about this subject.

When you borrow money, though, inflation might be your friend, depending on the real interest rate. If the inflation rate is higher than the interest rate, the money you owe is worth less in real terms eventually. However, when deflation happens, your debt burden might increase in real term. In this way, deflation may redistribute money from debtors to creditors, worsening the financial position of people in debt. In economic slumps, countries often experience deflation, which is particularly harmful when plenty of people are indebted. This is what occurred after the 2008 financial crisis. In this situation, first stated by Irving Fisher after the Great Depression, the real value of loans increased, which further hindered economic recovery.

However, as Farrell (2004) argues, deflation might be an acceptable feature of a prosperous economy if it is relatively mild and caused by supply factors. The broad expansion of Internet usage and globalization allows suppliers to continually reduce their costs and consumers to find the lowest price, implying a constant downward pressure on prices.

If you are interested in this topic, make sure to check out our time value of money calculator as well.

Hyperinflation

Now that we have seen how deflation can disrupt an economy let's consider a situation when the overall price levels rise at an extremely high rate. This phenomenon is called hyperinflation, and, according to Cagan (1956), the first to propose a formal definition, it occurs when prices increase by 50% or more in a month.

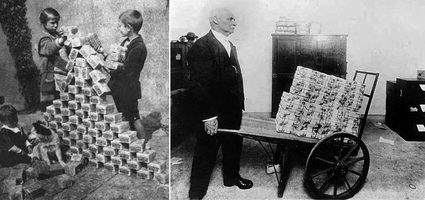

One of the most famous and severe examples of hyperinflation was in 1920s Germany, where the Papiermark (the German currency at the time) became so worthless that kids were playing with the blocks of banknotes.

Nevertheless, Hungary had the highest monthly inflation rate ever documented, coming in at (41.9 quadrillion percent) in July 1946, which means that prices were doubling roughly every 15 hours and reached a whopping 207 percent daily inflation rate.

The Hungarian currency, the pengő, lost so much of its value in such a short time that the bilpengő (one trillion pengő) note was issued to alleviate calculations. Before the new currency, the forint was introduced, even the 100 million bilpengő note was effectively worthless.

There are several reasons hyperinflation has a devastating impact on an economy. People will tend to hoard goods because of rising prices, even those they don't need, which can cause empty shelves in shops—money in saving accounts vanishes, crushing consumers' net worth. Also, because people aren't depositing their money, banks and lenders may go bankrupt. Governments fail to provide public services since tax revenues, for example, sales tax or value-added tax, also plunge. Printing more money (thus further increasing the money supply) becomes the only choice, making the hyperinflation even worse.

Hyperinflation is not only a feature of distant history: Zimbabwe experienced extreme inflation as well, peaking in November 2008 when prices doubled daily on average.

Inflation and how it affect to investors

Inflation is very detrimental to the stock market's bull run. During inflationary times, it affects the present value of the company's free cash flow. Consider it this way: if inflation rises, the free cash flow in the future losses buying power. Consequently, stock prices fall.

Furthermore, during inflationary times, government tends to raise the reference interest rate, which affects the company's debt. They will have to pay more in the long run, reducing the net income.

There are two ways investors could protect themselves against rising prices:

-

One of them is analyzing companies by their Graham number. Remember that the Graham number shows stocks trading at a lower price than their fair value. That means you are getting businesses at a discount, reducing your drawdown long-term risk. Continue learning about this in the Graham number calculator.

-

Hedging their portfolio with gold futures contracts. Historically, investors have chosen gold as a defensive asset against inflation. Hence, you could do the same and make some money to offset any portfolio losses.

How does inflation affect purchasing power?

Inflation negatively affects the buying power of a country's currency. Inflation causes an increase in the cost of goods and services. So if a loaf of bread costs $2 this year, it might cost $2,50 next year. Thus, thanks to inflation, the value of your money (and your ability to purchase goods, i.e., your "purchasing power") has become lower thanks to inflation.

What is the cumulative inflation rate if a basket of food increased by $200?

Assuming that the initial cost of the basket of food is $100 and the final price $300, the cumulative inflation rate is 200%.

We use the following formula to calculate this:

inflation = (final price − initial price) / initial price × 100

How do I calculate the inflation rate on a basket of food?

To calculate the inflation rate on a basket of food, follow these steps:

- Get the initial (IP) and final prices (FP) of the basket of food.

- Use the following formula:

inflation = (FP − IP) / IP × 100 - Substitute the variables.

- Calculate the inflation.