Roth IRA calculator

Roth IRA calculator helps you to determine the contribution amount you are eligible to make to a Roth account and the returns for you to achieve your retirement goals. A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

How much do you pay in taxes annually? Let's see if you pay 20% of your income in taxes that means you pay 20% of your 40-hour workweek. That is, 20% x 40 hours = 8 hours of your work goes to tax. It is the same as four days of work per month — about two months per annum. Imagine how much you lose when you consider that you still have to pay taxes on the money you've invested in your retirement account?

The Roth IRA helps you avoid paying those taxes. But you must obey specific rules and limits if you want to enjoy its full benefits. If you are curious to know:

- What is a Roth IRA?

- How to open a Roth IRA

- How much can you contribute to a Roth IRA?

- When can you withdraw from your Roth IRA? or

- What are the Roth IRA income limits?

This article will answer all your questions.

What is a Roth IRA?

A Roth IRA is an individual retirement account (IRA) in which your money grows tax-free, and you can make qualified withdrawals on a tax-free basis under specific rules. An IRA is a tax-advantaged savings plan designed to help you save for retirement. The difference between the Roth IRA and the traditional IRA is that:

-

Roth IRAs deposits are made with after-tax dollars while traditional IRAs are funded with pre-tax dollars.

-

Roth IRA contributions are not tax-deductible, but traditional IRAs' contributions are tax-deductible.

-

You don't pay income tax when you withdraw money from your Roth IRA during retirement, but you do when you withdraw from a traditional IRA.

-

You can leave money in your Roth IRA or continue to contribute from your income at any age. But you must start taking money or required minimum distributions (RMDs) from your traditional IRA at 72 years. (And to know all your options, take a look at our rmd calculator as well.)

-

You are eligible to contribute to a Roth IRA even though you have a 401(k) plan. For a given year, you may be ineligible to contribute to a Roth IRA but still be eligible to contribute to a traditional IRA.

Don't forget to check out our retirement calculator. It could prove to be more than just a tool.

How to open a Roth IRA

You can open a Roth IRA at any time of the year, but you must make your contribution for the year before the tax filing deadline, typically April 15 of the following year.

First, you must select an IRS-approved brokerage or bank to make your contributions in cash or checks. Afterward, you fill out the paperwork, including providing your identification details and beneficiaries' information.

Then, you can select an investment option to invest your money, such as mutual funds, stock, bonds, exchange-traded funds (ETFs), certificate of deposits (CDs), real estate investment trusts (REITs), or money market funds.

Different financial institutions provide a variety of investment options and fee structures. It would help if you made an informed decision when choosing your IRA provider to take full advantage of your Roth account. You can hire a financial advisor to help you manage your assets or consider the following options:

-

Open a Roth account with an algorithm-based online company. These companies use your personal information, risk tolerance level, and goals to build an appropriate asset mix, allowing you to enjoy a handoff approach to your investment.

-

If you prefer to be an active investor and make trades, you need an IRA provider with low trading costs, diverse stock or ETF offerings, and preferably no minimum account balance

-

Use a diversified mutual fund provider; or

-

Open a Roth account at a bank. You can check to see if your bank offers a Roth IRA account and the specific account requirements or discounts. The bank allows you to have all your financial accounts in one place, but most offer savings vehicles like CDs that are generally low yielding.

Thus, you can choose between a low-cost "do-it-yourself" approach to your Roth account investment or pay fees for professional management. Either way, your Roth IRA return's performance will vary depending on which assets you decide to invest in, but ALL of the return and compound interest earned is 100% yours!

You must regularly check your account statements to reevaluate your investment choices. And you might also want to check out our compound interest calculator just to be on the safe side.

Finally, you have to decide on your annual contribution schedule. You can choose to make a single lump-sum payment or contribute in small installments over the year. Or you can roll over money from another retirement account or use a Roth IRA conversion.

Who is eligible for a Roth IRA?

You are eligible for a Roth account if you satisfy the following two requirements:

-

You have earned income or compensation from work. The maximum you can contribute to a Roth in a year is your compensation or $6,000 ($7,000 if you're age 50 or older), whichever one is lesser. This contribution can be reduced by:

-

Application of income and filing status limitation rule; or

-

Any amount you contributed to your traditional IRA for the same tax year.

-

-

You meet certain income limitations concerning filing status and modified adjusted gross income (MAGI). The amount you can contribute begins to shrink at certain thresholds for MAGI. It keeps shrinking, eventually eliminating as income rises.

We have a stand-alone magi calculator if you want to know more. Knowledge never hurts anyone.

Roth IRA Conversion – If your income is too high for a Roth IRA

If your income is too high for a Roth IRA according to the particular income and filing status limitation rule above, you can use a "back door" to open a Roth account.

The "back door" strategy is to contribute to a traditional IRA — which has no income limits. Then, you can move the money into a Roth IRA using a Roth conversion. But make sure you understand the tax consequences before using this strategy because a Roth conversion is permanent. You will not be able to move the contribution back into a traditional IRA after it's done.

Might we suggest looking at ROI calculator to help you understand the profit and loss on your investments?

How much can you contribute to a Roth IRA?

The IRS sets limits to the amount you can contribute to your Roth IRA. They also make periodic adjustments to the IRA contribution limits according to inflation. Unlike

with a traditional IRA, the amount you can contribute to a Roth IRA is based on your modified adjusted gross income (MAGI) and, if you are married, on your combined adjusted gross income.

There is a unique formula to calculate the allowable contribution to a Roth IRA. The formula is as follows:

Ineligible contribution % = MAGI - Threshold level / Phaseout level - Threshold level

The result is the percentage that you cannot contribute to the Roth IRA.

The Threshold level and Phaseout level for the 2020 tax filing status limits are tabulated below:

2020 Limits | ||

|---|---|---|

Filing Status | Threshold level | Phaseout level |

Single | $124,000 | $139,000 |

Married filing jointly | $196,000 | $206,000 |

Married filing separately | $0 | $10,000 |

Example: Roth IRA contribution for a couple filing jointly

John and Issa Doe are both 32 years old. They have a modified adjusted gross income of $198,000 in 2020 and filed a joint tax return. How much can each contribute to a Roth IRA?

Using the formula for a married taxpayer filing jointly:

-

Find the ineligible contribution %.

= $198,000 - $196,000 / $206,000 - $196,000

= $2,000 / $10,000 = 0.2

= 20% -

Determine the ineligible amount using the maximum contribution allowed for persons under 50 years.

= 6,000 × 0.2 = $1,200 -

Compute the eligible contribution.

= $6,000 - $1,200

= $4,800

The eligible contribution must be calculated separately for each spouse using their combined income. In this example, John and Issa could each contribute up to $4,800 to a Roth IRA in 2020, for a total contribution amount of $9,600.

Therefore, the eligible contribution to a Roth IRA is given by the formula:

eligible contribution = maximum contribution - (maximum contribution × ineligible contribution %)

2020 Limits | ||

|---|---|---|

Filing Status | Threshold level | Phaseout level |

Single | $124,000 | $139,000 |

Married filing jointly | $196,000 | $206,000 |

Married filing separately | $0 | $10,000 |

Roth IRA limits

The chart below summarizes the qualification status, and Roth IRA limits for 2020.

Filing status | 2020 MAGI range | Maximum annual contribution |

|---|---|---|

Single, head of household or married filing separately (if you didn't live with spouse during year) | Less than $124,000 | $6,000 ($7,000 if 50 or older) |

$124,000 up to $138,999 | Contribution is reduced | |

$139,000 or more | No contribution allowed | |

Married, filing jointly or qualifying widow(er) | Less than $196,000 | $6,000 ($7,000 if 50 or older) |

$196,000 up to $205,999 | Contribution is reduced | |

$206,000 or more | No contribution allowed | |

Married, filing separately (if you lived with spouse at any time during year) | Less than $10,000 | Contribution is reduced |

$10,000 or more | No contribution allowed |

Spousal IRA contribution rules

Well, like all things IRS, there are always exceptions and caveats. One such is the spousal IRA contribution rules. If your compensation is less than the $6,000 or $7,000 limit, as applicable, then you are permitted to use your spouse's compensation when making your Roth IRA contribution. It means that both of you will be able to contribute up to the maximum $6,000 or $7,000 as applicable.

For example, you have a compensation of $2,500 or $0.00, and your spouse has a compensation of $78,000. You are both age 55. You are eligible to contribute $7,000 to your Roth IRA. Your spouse is also eligible to contribute $7,000.

The following rules must be satisfied:

-

You and your spouse must each have your own traditional IRA;

-

You must be married as of the end of the tax year (i.e., December 31);

-

You must file a joint income tax return;

-

You must have compensation inclusive of gross income, which is less than that of your spouse; and

-

The combined contribution by both spouses must equal or be less than their combined eligible compensation.

Therefore, one spouse will need to earn at least $12,000 to cover the $6,000 annual maximum if they are both aged under 50.

When can you withdraw from Roth IRA?

Roth IRA withdrawal rules are more flexible than those for a 401(k) and the traditional IRA because you already paid taxes on the money you contributed. So, you may withdraw contributions - the money you put into the account – tax and penalty-free at any time.

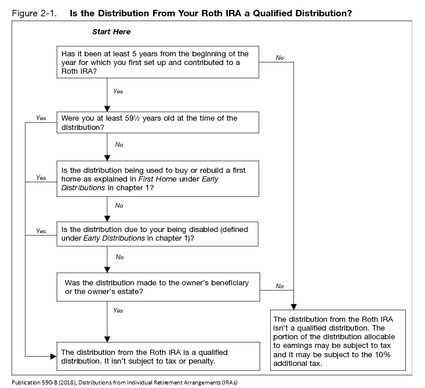

The IRS calls these withdrawals Distributions. A distribution is considered a "qualified distribution" If you take out only an amount equal to the sum you've put in.

A qualified distribution is not considered taxable income and is not subject to penalty, regardless of your age or how long it has been in the account.

However, different rules apply to the earnings generated on your Roth IRA. Distribution of your Roth IRA return or investment earnings qualifies based on your age and if you've met the 5-year rule.

If you are 59.5 years and older, and you've owned your Roth IRA for more than five years, you'll owe NO income taxes or penalties.

If you are 59.5 years and older, and you've owned your Roth IRA for less than five years, you'll owe income taxes but no penalty.

If you are younger than 59.5 years and you've owned your Roth IRA for more than five years, You can avoid taxes and penalties on earnings withdrawals if you meet one of the following exceptions:

- You are withdrawing for a first-time home purchase (up to $10,000 limit);

- The withdrawal is due to a disability; and

- The withdrawal is made to a beneficiary or your estate after your death.

If you are younger than 59.5 years and you've owned your Roth IRA for less than five years, you'll owe income taxes and a 10% penalty if you withdraw earnings from your account. You can avoid the 10% penalty but not the income taxes if you meet one of the following exceptions:

-

You are withdrawing for a first-time home purchase (up to $10,000 limit);

-

The withdrawal is due to a disability;

-

The withdrawal is made to a beneficiary or your estate after your death;

-

The withdrawal is for qualified education expenses;

-

You are withdrawing up to $5,000 in the year as the expense for childbirth or adoption of your child;

-

The withdrawal is for unreimbursed medical expenses over 10% of your adjusted gross income (AGI) for the year; and

-

The withdrawal is for health insurance premiums while you're unemployed.

Pros and Cons of a Roth IRA

Summarily, a Roth IRA is the best option if you are not interested in the immediate tax break of a traditional IRA. It provides a tax-free income in retirement. Individuals opt for a Roth account because they expect to be in a higher tax bracket when they retire. Some open or convert to Roth IRA because they fear an increase in taxes in the future, but nobody knows the future, right? Nevertheless, opening a Roth IRA early means you enjoy a tax-free income stream in your retirement.

The Pros of a Roth IRA are:

- Tax savings advantage.

- No RMDs.

- No age limits.

- No taxes for your beneficiaries.

- No employer-plan restrictions.

- Tax-free distributions.

- Variety of investment options.

- Flexible contribution plan.

Cons to consider are:

- MAGI and Income restrictions.

- Non-tax-deductible contributions.

- 10% penalty on early withdrawals (before age 59½) of investment earnings.

- You cannot use your Roth IRA funds as collateral.

- If your current tax rate turns out higher than your income tax rate in retirement, you may not truly enjoy the benefits of a Roth IRA.