Texas Tax Calculator

The useful Texas tax calculator helps you to determine how much of your income will be paid to Taxes when officially living in Texas.

Are you worried about understanding the complexities behind calculating your income tax in Texas? Don't fret! Texas is one of the most tax-friendly states in the US, as you will see in this article.

Below we cover how to calculate tax in Texas state, the tax brackets, deductions, and contributions. So let's break down those equations together... It won't be as tricky at all!

What are the Texas taxes?

Texas taxes are the taxes a Texas citizen has to pay. These include the FICA tax, the federal income tax, and the property tax .

Tax type / Filing status | Single | Married & Jointly | Married & Separately | Head of Household |

|---|---|---|---|---|

FICA | 7.65%: Social security (6.2%) + medicare (1.45%) taxes | |||

Federal income tax | Progressive tax brackets from 10% to 37% | |||

Deductions in USD | 12,950 | 25,900 | 12,950 | 19,400 |

State income tax | No state income tax in Texas | |||

Local tax | Only San Francisco has a local tax: 0.38% paid by the employer (payroll tax). | |||

Sales tax | 6.25% - 8.25%: Tax paid for the sale of certain goods and services. | |||

Property tax | On average, 1.8%. However, there is no Texas state tax. Local counties define the property assessed value tax. | |||

The Texas income tax calculator already includes all the specifics indicated above except sales tax. In case you want to dig into the federal income tax, you should check the tax bracket calculator.

How do I calculate Texas income tax?

Before we start, we need information, including your filing status, as indicated in the Texas income tax rate table we shared above. So:

- Suppose you are a single filer with an adjusted gross income (AGI) of $31,000 living in Texas state and want to know your 2022 total income tax. Let's start with your FICA, which will be: .

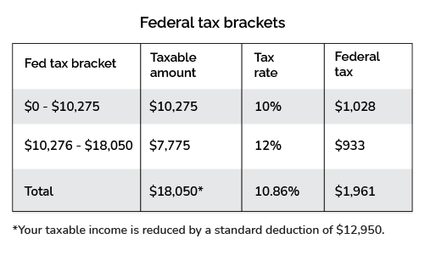

- Now, it is time for your federal income tax. After considering the 2022 deductions we showed above, your taxable income is $18,050 (that is because ). Consequently, considering the federal tax progressive income, you pay $1,028 plus 12% of the amount over $10,276, which equals a total federal tax of $1,961.

Let's explain that a bit more: try the Texas income tax calculator and see the second table. You will notice that you reach the 12% bracket, but your income is only partially taxed at that percentage. Check the following table:

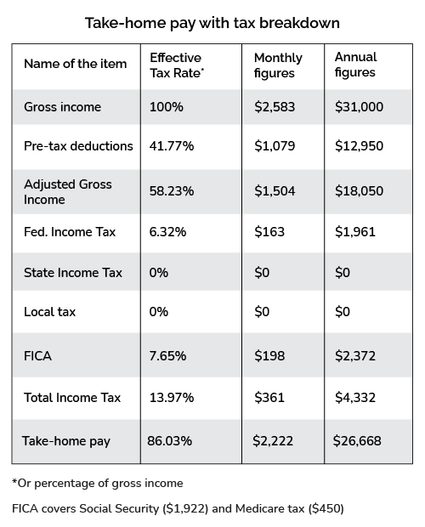

- Sum federal tax and FICA and subtract the resulting value from your AGI: . Congratulations, you have got your Texas annual take-home pay. Check the next table for a summary of all we explained above:

In addition, you can estimate your take-home pay for a selected pay frequency using our tool as a paycheck tax calculator for Texas. For example, if you want to see your monthly take-home pay, you need to select monthly pay frequency, resulting in the estimated monthly take-home pay of $2,222.

How to calculate Texas property tax?

It is important to mention how properties are taxed in Texas: A property could be within the jurisdiction of one or multiple local taxing entities, such as being in a hospital district, college district, or other. Each local taxing entity could have its own taxing rate, which would add up to the total tax to be paid by the homeowner. In other words, a taxpayer’s annual tax rate is the combined total of the taxing units that have jurisdiction over the property’s address.

Regarding calculation, you can use the Texas property tax calculator or do as follows:

- Get your assessed home value. Consider checking if you can apply for deductions. Notice you can deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales taxes.

- Find the property tax rate for your house location. For example, Anderson county has a property tax rate of 1.41% in 2022.

- Multiply your assessed home value by the property tax rate.

- Remember you can use the Texas property tax calculator if you still have doubts about how property taxes are calculated in Texas.

That's it. You are ready to go!

Finally, if you are considering moving to Alabama, New York, Illinois, or California, we recommend checking their respective tax calculators:

Disclaimer

You should consider the Texas tax calculator as a model for financial approximation. All figures and balances are estimates based on the data you provided in the specifications that are not exhaustive, despite our best effort. In addition, the calculator potentially omits information relevant to determining the exact income tax figures.

For these reasons, we created the Texas tax calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive helpful feedback and advice.

Does Texas have state income tax?

No. As the Omni Calculator tool, the Texas tax calculator, indicates, Texas doesn't have state or local income tax. However, they do have property tax which depends on each county. In 2022, the average effective property tax rate was 1.69%.

How do I calculate tax in Texas?

You can use the Omni Calculator tool, the paycheck tax calculator for Texas, or do as follows:

- Calculate your FICA. That is 7.65% of your adjusted gross income (AGI).

- Obtain your federal tax rate. Remember, there is a $12,900 deduction, and it's a progressive tax.

- Subtract the FICA and federal tax from your AGI, and you will have your take-home pay.

How much tax should we pay if married and earning $64,000 in Texas?

Supposing you are a married couple filing jointly, you owe $9,057. Your take-home pay would be $54,943. Let's break it down in this tax calculator for Texas:

- Start calculating your FICA. That is 7.65% of your adjusted gross income (AGI): $4,896.

- Obtain the progressive federal tax after deducting $25,900 because you are a married couple. The resulting tax is $4,161.

- Sum federal tax and FICA. The result is the amount you owe in taxes: $9,057.

What is the property tax in Texas?

The Texas property tax is the payment a homeowner owes to the county where the property is located. The average effective property tax rate in Texas is 1.69%, with counties that can charge up to 2.23%, like Bailey.

The value of the property and its location are the most relevant factors used in determining the property tax. Omni Calculator tool, the texas tax calculator, includes the tax levels for all counties.