Illinois Tax Calculator

The stunning Illinois tax calculator helps you calculate how much of your Adjusted Gross Income (AGI) you will devote to taxes during 2022. Although Illinois has a flat income state tax, other taxes, such as federal and property taxes, might be a headache for the layman. That's why we made the Illinois income tax calculator — so you can take a realistic approach to the taxes you will have to pay on April 2022 and plan accordingly.

The Illinois paycheck calculator covers a wide range of topics, including effective tax rates, tax brackets, state taxes, deductions, and even tax exemptions — so keep reading to find out how to calculate your Illinois state income tax.

Which are the taxes the Illinois tax calculator includes?

In Illinois, paycheck taxes include federal income tax, state income tax, and FICA taxes (Social Security and Medicare). However, before we explain how to calculate Illinois state tax, we will explain your adjusted gross income (AGI).

Your AGI is your yearly income with a few deductions, which are commonly referred to as "above-the-line" deductions. These include items like contributions to specific types of retirement accounts, particular business costs for the self-employed, and particular educational costs.

Once we have our AGI, we can work out the federal tax rate and the state income tax. On the other hand, Illinois taxpayers have to cover their property tax according to the jurisdiction where the property is.

Summing up the taxes mentioned above:

Tax type / Filing status | Single | Married & Jointly | Married & Separately | Head of Household |

|---|---|---|---|---|

FICA | 7.65%: Social security (6.2%) + medicare (1.45%) taxes | |||

Federal income tax | Progressive tax brackets from 10% to 37% | |||

Deductions in USD | 12,950 | 25,900 | 12,950 | 19,400 |

State income tax | Flat income tax: 4.95% | |||

Property tax | On average, 1.8%. However, it can vary greatly accordingly to the property jurisdiction location. | |||

Take a look at the state tax component in the table above. Notice the difference with other tax tools we have covered in the past, such as the New York Tax Calculator: The Illinois state tax is flat. Similarly to Colorado, Kentucky, and others, there is only one single tax rate at which everybody is taxed:

The Illinois 2022 state tax is 4.95%. It applies to single filers, married/registered domestic partners who file separately, and married couples filing jointly.

Besides, there are no tax deductions. But, there are personal exemptions that follow the next table:

Single | Couple | Dependent |

|---|---|---|

$2,375 | $4,750 | $2,375 |

It is important to mention that taxpayers cannot claim the personal exemption if their adjusted gross income exceeds $250,000 (single filers) or $500,000 (married filing jointly).

Regarding real estate, the Illinois property tax calculator includes the full set of jurisdictions and their respective tax rate. Notice there is no state property tax. One of the cheapest property tax rates is Pulaski County, with a tax rate of 0.980%, while the most expensive one is Lake County, with a tax rate of 2.950%.

How do I use the Illinois paycheck calculator?

Before we start, we need a set of information that includes your filing status, as indicated in the Illinois income tax rate table we shared above. Then:

-

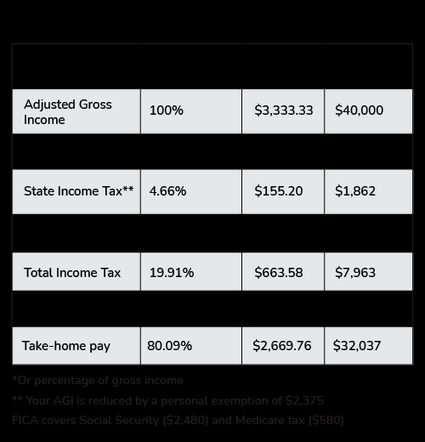

Suppose you are a single filer with an AGI of $40,000 living in Illinois and want to know your 2022 total income tax. Let's start with your FICA, which will be: . The result is $3,060.

-

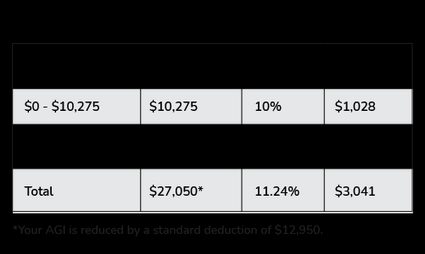

Now, it is time for your federal income tax. After considering the 2022 deductions we showed above, your taxable income is $27,050 (that is because ). Consequently, considering the federal tax progressive income, you pay $1,028 plus 12% of the amount over $10,275, which equals a total federal tax of $3,041.

Let's explain that a bit more: in the

Resultssection of our Illinois tax calculator, press theDisplay...dropdown menu and selectadd federal income tax brackets. You will see a table like the one below:

In that table, you'll notice that you reach the 12% bracket, but your income is only partially taxed at that percentage. Instead, 11.24% is the effective tax rate at which your income is evaluated.

-

We continue calculating the Illinois state income tax. Illinois applies a flat state tax rate, but also you might be eligible to reduce your AGI by a personal exemption, which is $2,375 in the present case.

-

Notice we do not have local taxes. Consequently, the last step would be to subtract all the taxes:

The take-home pay amount is $32,037, as you can see in the Illinois income tax calculator.

How do I use the Illinois income tax calculator for a married couple?

You can use this Omni Calculator tool Illinois income tax calculator or do as follows:

-

Suppose you are married, filing jointly, and making the median income in Illinois state: $73,000 annually. Subtract 7.65% of $73000, your adjusted gross income (AGI). That will go to your FICA: $5,585.

-

Find your marginal tax rate. After deductions ($25,900), we have a marginal tax rate of 12% on , but remember, the marginal tax rate is only the last bracket we fit in. In this case, you will be taxed progressively: 10% up to $20,550, equivalent to $2055, and the rest at 12%. Thus, we must pay $2,055 plus 12% of the amount over $20,550 (the last bracket), or $5,241 in total. Such a value represents an effective tax rate of 11.13%.

-

Obtain Illinois state tax: which results in $3,614.

-

Finally, to get your take-home pay, subtract all the taxes stated above from your AGI. After doing that, we obtain an income after tax of $58,560. You can verify the results in the awesome Illinois paycheck calculator.

How are property taxes calculated in Illinois?

In Illinois, property tax is calculated by multiplying the value of the property by the tax rate. The value of the property is determined by the local assessor, and the tax rate is set by the county. You can use the Illinois property tax calculator or do as follows:

-

Get your assessed home value. Consider checking if you can apply for deductions or exemptions. The majority of elderly homeowners who own and live in their property as their primary residence and are 65 years of age or older are qualified for property tax exemption.

-

Find the property tax rate for your house location. For example, Kendall county has a property tax rate of 2.86% in 2022.

-

Multiply your assessed home value by the property tax rate.

And that's it. You are ready to go!

Finally, if you are considering moving to Alabama, Texas, New York, or California, we recommend checking their respective tax calculators:

Disclaimer

You should consider the Illinois tax calculator as a model for financial approximation. All figures and balances are estimates based on the data you provided in the specifications that are not exhaustive, despite our best effort. In addition, the calculator potentially omits information relevant to determining the exact income tax figures.

For these reasons, we created the Illinois tax calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive helpful feedback and advice.

Does Illinois has local income tax?

No. Illinois only has the federal income tax, the state income tax, and FICA taxes (Social Security and Medicare). The tax rate can range from 10% to 37%, depending on your income and filing status.

Illinois has a flat state income tax rate of 4.95%, meaning all taxpayers in Illinois pay the same. FICA taxes consist of Social Security tax (flat rate of 6.2% ) and Medicare tax (flat rate of 1.45%).

Does Illinois has state income tax?

Yes. Illinois has a flat state income tax rate of 4.95%, which means that all taxpayers in Illinois must pay the same income tax rate, regardless of income level or filing status. There are personal exemptions that can range from $2,375 to $4,750, depending on whether you are single or filing it as a couple.

How much tax do I owe if we earn $75,000 in Illinois?

Assuming married jointly filing and couple tax exemption applicability: your total income tax is $14,696.

-

Subtract the pre tax deduction: $25,900 from AGI. Your taxable income is $49,100 (12% marginal tax rate), making a federal income tax of $5,481.

-

Subtract FICA (7.65% of AGI).

-

Get the state income tax: Subtract exemption couple $4,750 from AGI. The tax rate is 4.95%, and you owe $3,477.

-

Sum all the values above. Your tax is $14,696.

What is the property tax in Illinois?

In Illinois, property tax is a fee that homeowners have to pay to the county where they have their property. The average property tax rate in Illinois is 1.8% with counties that can charge up to 2.66%, like Kaine county. The amount a homeowner must pay depends on the property value and its location. The Omni Calculator tool includes the property tax rates of all Illinois counties.